In a world of AI (artificial intelligence), misinformation, and cookieless browsing, do eCommerce brands still understand their customers? We asked 500 shoppers to find out.

In this article

Online brands, platforms, and technologies continue to multiply faster than anyone can count. Shoppers not only have an unprecedented choice of products and services, they also have thousands of ways to buy them.

Small-to-midsize enterprises (SMEs) that sell online may be struggling to understand how today’s shopping journeys compare to those of ten or even five years ago. Do shoppers still feel loyalty towards brands? Are AI-powered conversational assistants taking over? Are consumers turning away from traditional social media towards channels where advertisers can’t access their data?

To find out the answers, and understand what brands need to do next, we surveyed 500 people in Canada who shop online several times a month or more. In this first article, we explore how the customer experience is changing, whether loyalty still matters to consumers, and what sources shoppers trust in an era of misinformation.

You can scroll down to the bottom of this article for a full methodology.

- Search engines (used by 55%) and retailer websites (43%) are much more popular places to start online shopping journeys than social media (13%).

- Price and quality are major factors for those who tend to remain loyal to brands, but they are also the biggest drivers for those who prefer to try different ones.

- The vast majority (72%) say they do not trust product reviews by social media influencers, and 89% say they see too many ads on social media.

Digital customer journeys still start and end in the same places they always have

Today’s social media platforms are unrivaled at attracting and retaining eyeball time. But people do not see them as major destinations for eCommerce.

To a large extent, respondents in our survey begin their online searches for new products and services in familiar places: search engines, retailer websites, and marketplaces.

And while buyers may make detours along the way, their journeys also end in unsurprising places. The top three destinations for purchasing online are individual retailers’ websites or apps (47%), department store websites (36%), and eCommerce marketplaces (31%).

Only 8% of respondents end up making purchases on social media, suggesting that people don’t view it as a compelling place to buy, or that most purchase funnels simply do not lead there.

Key takeaway: Online purchase journeys haven’t yet shifted to social media, according to our research. But understanding exactly how buyers find your products and decide to buy them is crucial for any e-commerce business. People may be consulting social media along the way to understand what other people think of your brand, for example.

If you don’t already use them, customer journey mapping tools are a worthwhile investment. They help you analyze how people navigate through your website, app, or digital products, so you can optimize their experience. Combined with data from your online advertising channels (like social, search, and pay-per-click), you can build up a comprehensive picture of how buyers interact with your brand at every touchpoint.

Price and quality are the biggest buying decision factors

Even though basic online shopping journeys do not appear to be changing dramatically, retailers may be wondering if consumers’ expectations of brands are. This is understandable, given increased awareness of how companies conduct themselves. Our 2024 Consumer Trends eBook shows, for example, that 84% of consumers would like more transparency and information from brands about their sustainability efforts.

Overall, price and quality still dominate purchasing decisions. For purchases of new products in the past 12 months, 59% in our survey said lowest price was in their top considerations. Meanwhile, 51% said discounts or promotions were one of the most important factors, and 47% factored in brand trust.

Among loyal consumers (those who say they tend to purchase from the same brands or retailers repeatedly), the main drivers are, again, price (cited by 78%) and quality (cited by 75%). These two factors are far ahead of the next biggest driver — a loyalty or rewards program (51%). These drivers are equally valid for those who like to try different brands: 77% are motivated by seeking lower prices, and 58% are seeking better quality.

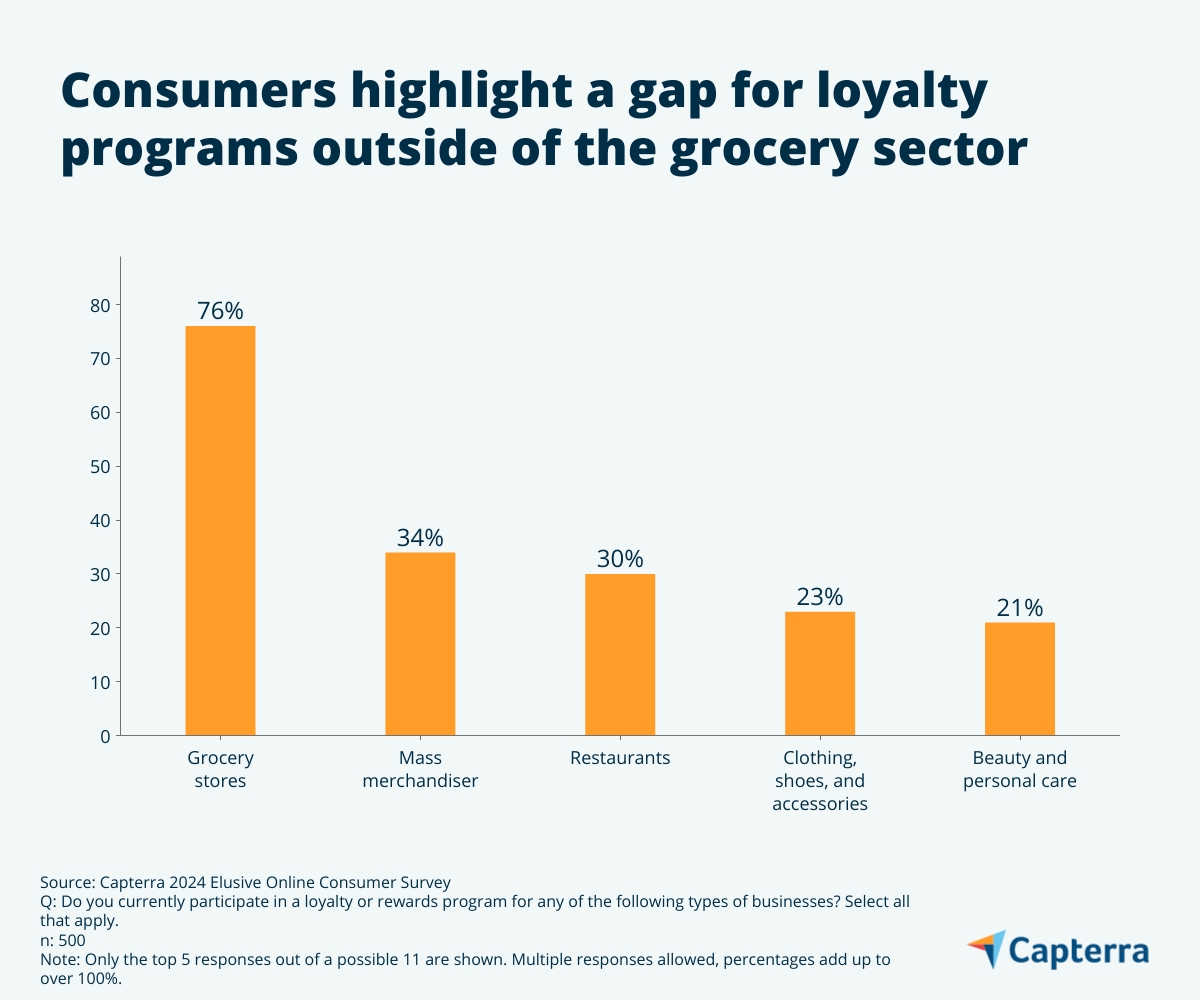

As well as doubling down on price and quality, there may also be room for online retailers to make more of loyalty programs. Over three-quarters (76%) of consumers in our research said they are members of such a scheme at their grocery store, but no other business type has a higher market penetration than 35%.

Key takeaway: The fact that price and quality are important for retail shoppers might not have surprised a shopkeeper in the 1800s. But those business owners would not have had access to the powerful pricing tools available to today’s SMEs.

Price optimization software, for example, uses historical data and predictive algorithms to work out the best price for your product, channel, or market condition. A related tool is competitor price monitoring software, which tracks prices across other retailers and can be useful for benchmarking and as a guide to when market prices rise and fall.

The Capterra Consumer Trends eBook also highlighted that loyalty programs and apps are especially popular in Canada. For those interested in running such a program, customer loyalty software helps strengthen relationships with rewards or points schemes, gift cards incentives, or VIP programs. Over time, they can boost loyalty — and sales— among key segments of your customer base.

How do brands earn the trust of online shoppers?

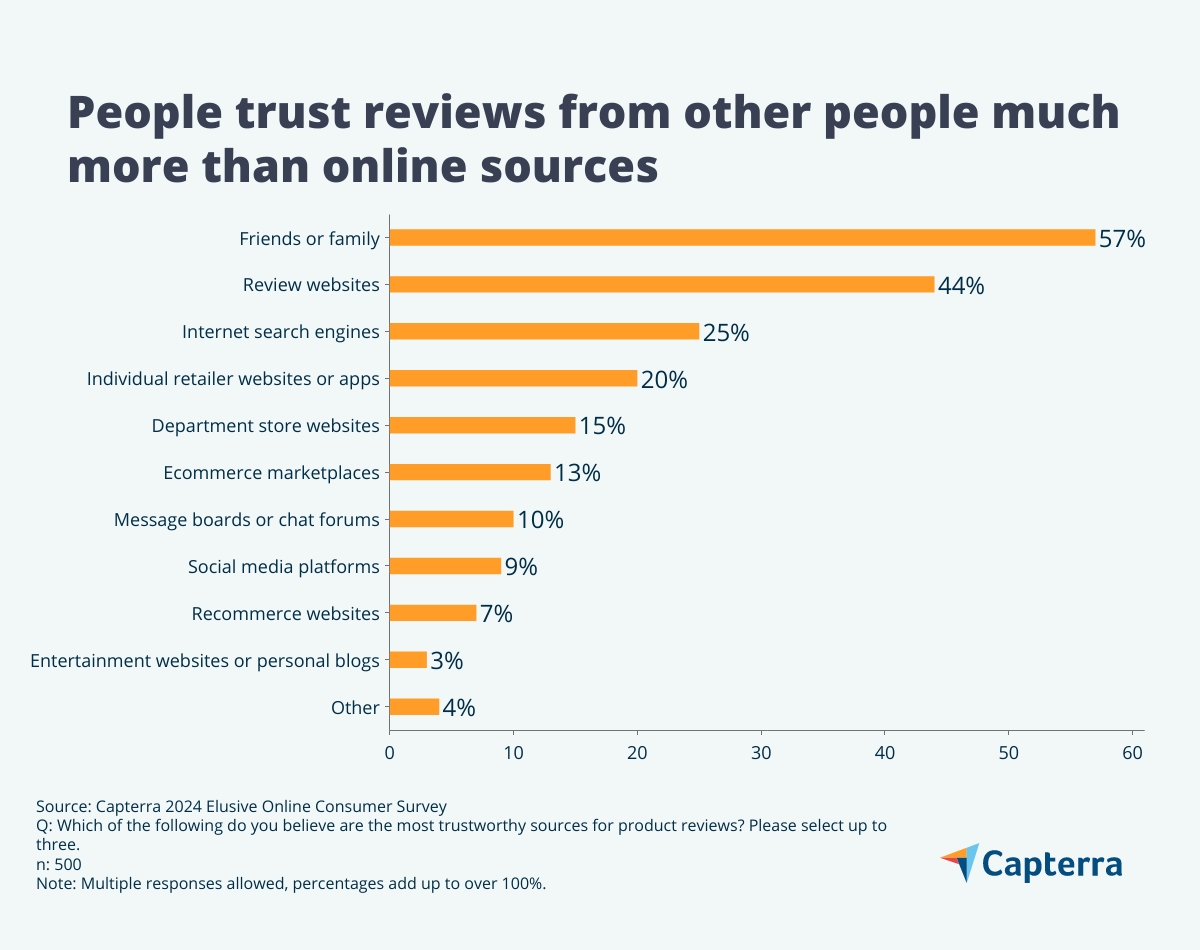

Given the importance of brand trust to buyers, retailers should be seeking to build this any way they can. Some choose to work with influencers. Others use content marketing to build up a reputation as a trusted voice in their area. Many rely on word of mouth from happy customers.

Our survey shows that the latter may be the most sensible long-term approach. Respondents tend to trust their friends’ and families’ views on products. A lot (but less than half) also have faith in review sites. And some think search engines are a source of truth. But very few rank social media or actual eCommerce providers highly.

Paid social media fatigue seems to be prevalent: 72% said they do not trust product reviews by social media influencers, but 62% trust reviews from regular social media users. The vast majority (89%) said they see too many ads on social media platforms.

To add complexity to retailers’ marketing analytics, recommendations between friends and families tend to happen where brands can’t see them. Of all the possible ways for shoppers to share recommendations with friends and family, only 17% said they use social media and 10% use message boards and online forums.

That said, these private discussions may not be hugely significant from a sales perspective. Only 37% of people said that they frequently make purchase decisions based on content shared through private social media channels.

Key takeaway: Skepticism of paid social media marketing means that buyers do not see it as a major source of influence behind their purchasing decisions.

The (apparent) success of many Instagram stars may tempt brands to work with influencer marketing agencies, but our research suggests that developing a robust organic user community may be a better long-term bet. Social media management software can help build that following across channels in a way that small businesses can manage.

By encouraging customers to talk openly about your product and brands, participating in these conversations, and promoting customer successes to your audience, you create a group of genuine brand advocates that can also help inform the strategic direction of your company. For SMEs that are serious about this approach, customer advocacy software can help streamline some of the processes involved and track your success.

Three ways to reach today’s elusive online consumer

1. Know your customer journey(s)

Brands need to understand how shoppers find their products and the places they go along the way to help them decide. These journeys may become more complex in the coming years, but dedicated tools can help map and analyze them.

2. Double down on price and quality

Shoppers will switch to a brand if it can offer lower costs and/or better quality. And they will stay with that brand for the same reasons. This isn’t a difficult concept, but it can be hard to know if your prices are competitive online. This is where pricing optimization software can help.

3. Build your brand with genuine advocates

Consumers are skeptical of paid marketing, especially on social media, so encourage happy customers to leave reviews or talk about your brand online. That requires investment in time and resources as you build a community, but it can help your brand trust, which significantly influences people’s purchasing decisions.

Methodology:

Capterra's 2024 Elusive Online Consumer Survey was conducted online in April 2024 among 500 respondents in Canada. The goal of the study was to learn about how today's online consumer shops. Respondents were screened to have shopped online several times a month or more often.