Rising prices and inflation in Canada have been points of concern for consumers over the last few years. To gauge the economic effects, reactions, and expectations regarding these issues, we surveyed 1,000+ Canadian consumers in charge of household expenses.

What we will cover

Consumers have faced a variety of issues in Canada over the last few years. In 2020, the COVID-19 pandemic imposed restrictions on the movement of goods and people, leading to clogs in the supply chain and a scarcity of some products. The following year, inflation began picking up and has been steadily increasing since then.

As a result, Canadians are being stung by higher prices and lower availability of products. How are they dealing with product shortages and price increases in Canada? Can retailers ease the economic pressure through the use of discounts, customer loyalty programs, and other measures?

To understand how Canadians are feeling the pressure of rising prices, from March to April 2023 Capterra conducted a survey of more than 1,000 Canadian consumers at least partially in charge of managing household purchases and expenses. For the full methodology, scroll down to the bottom of this article.

Consumers’ experience of inflation in Canada in 2023

There’s no doubt that Canadians who shop regularly for their households are feeling the effects of inflation. In fact, 82% are anxious to some degree about price increases, which includes a third (33%) who are “very” anxious. Naturally, those with lower income levels are more anxious than higher earners: 39% of respondents in the lowest earnings bracket of $50,000 or less reported the highest level of anxiety over rising prices.

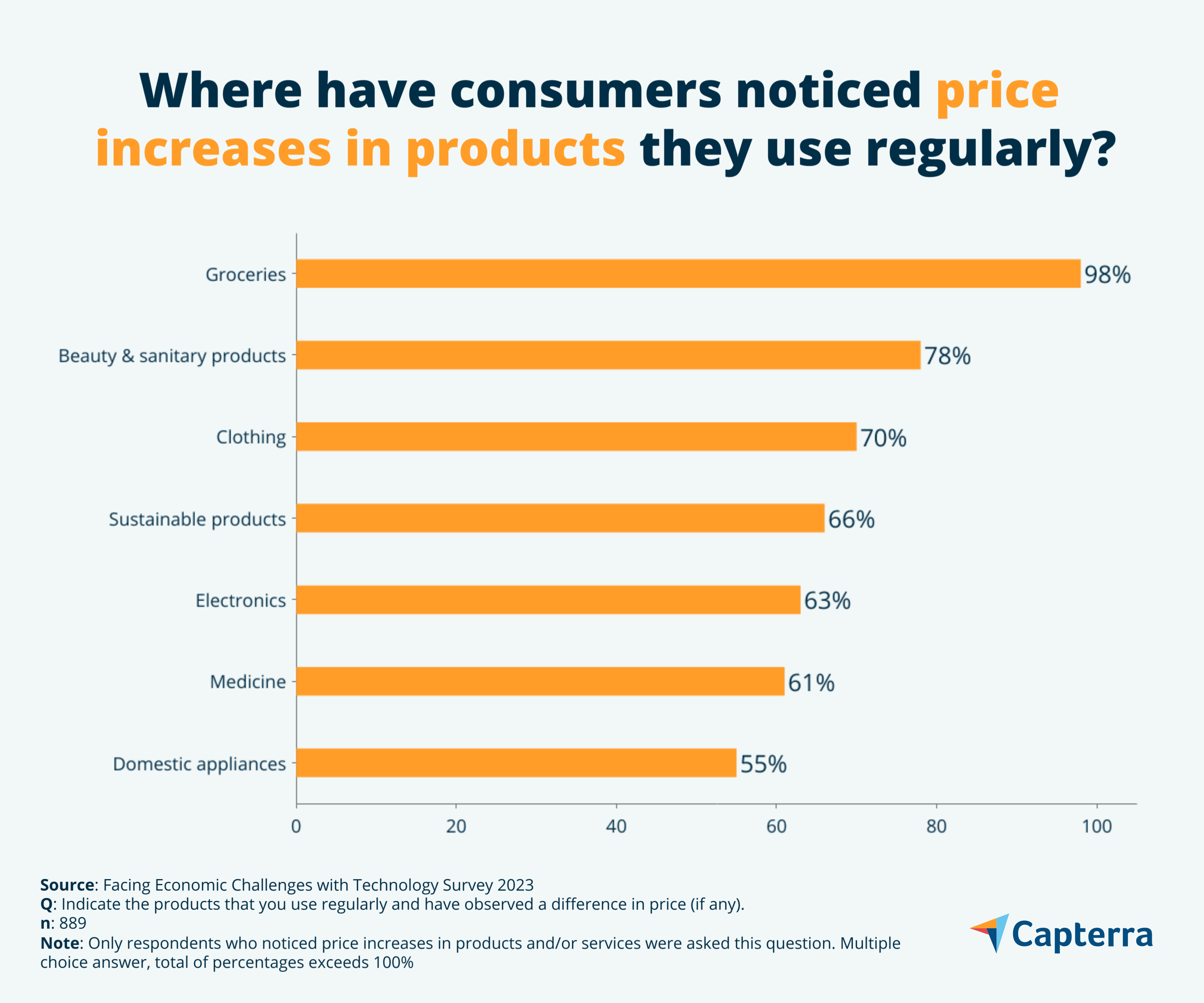

The financial anxiety Canadians feel is far from off-base. The majority of survey-takers (88%) noticed a price increase in a product and/or service in the last year. It seems Canadians are most aware of growing grocery prices: nearly all respondents who had noticed price changes (98%) took note of higher food prices.

The inflationary pressures of Canadian food prices have been well-documented over the past year, with many Canadians saying they were most impacted by rising grocery prices. Respondents to our survey also became widely aware of the increased prices of non-food consumer products like toiletries, clothing, and sustainable goods.

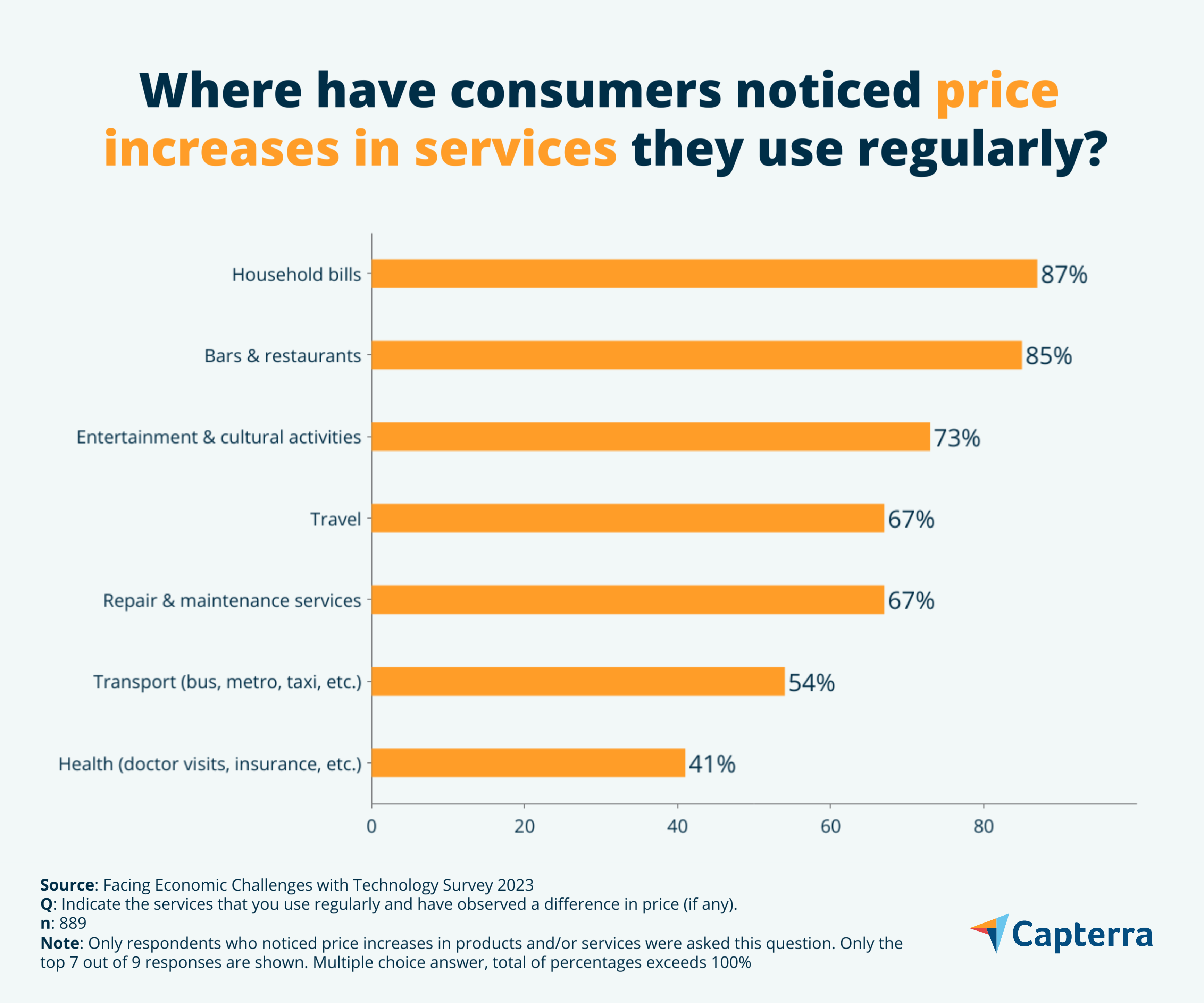

Consumer goods are not the only economic area to be affected by inflation. Nearly 9 out of 10 Canadian respondents who noticed an increase in prices (87%) also spotted price increases in household bills such as gas, electricity, water, and internet, at least partially driven by rising household fuel and natural gas prices. Recreational services such as bars and restaurants, entertainment activities, and travel were also seen to have become more expensive.

Most of the respondents who noticed price increases did so while shopping at a store in person (69%), though 15% also noticed later on when receiving the bill. Only 1% of respondents were first notified by the brand or company selling products and services at raised prices, showing that businesses are letting consumers find out about price changes on their own.

How can companies help customers facing price increases in Canada?

Retailers and service providers of all kinds may be facing reduced revenue as Canadians reduce or delay some expenses. Finding ways to help customers avoid cutting down their spending would also benefit sellers. However, more than half of surveyed consumers who’ve taken note of price changes (54%) feel companies aren’t making enough of an effort to help them manage rising prices as of right now.

When asked which responsive measures from companies would be most effective in alleviating inflationary pressures, these survey respondents had a range of ideas for assistance. Offering more discounts is seen as a good measure by 70%, while transparency around price changes and providing loyalty programs are preferred by 49% and 45% of respondents, respectively.

A look at shrinkflation statistics

Consumers seem to be acutely aware of raised prices, but that isn’t the only change they’ve noticed. Some shoppers have seen reductions to the size, quantity, or quality of products, a tactic known as shrinkflation. The statistics of our survey show that almost a third of respondents (31%) have noticed a decrease in product size and/or service scope.

Though more consumers in charge of household spending have noticed price increases than those who’ve noticed shrinkflation, there are a few product types where a majority took note of recent changes. Amongst those who noticed shrinkflation, regular users of the following products most commonly observed sized decreases in these categories:

- 79% in grocery items

- 36% in beauty and sanitary products

- 22% in sustainable products

- 17% in medicine

Some sectors of service have also experienced some version of shrinkflation, or the reduction of the scope of service in this case. Of the survey-takers who noticed these changes, reduced offerings were mainly observed amongst regular users of leisure activities such as the bar and restaurant industry (noticed by 29% of these respondents). However, the health industry, which provides patients with specialist visits, medical insurance, and more, was also noticed by 22% to have lessened the scope of their service.

Reducing the product size or scope of service on offer may be helping some companies survive economic uncertainty, but what help can consumers expect in response? Most surveyed respondents would ideally like to be offered more discounts, though increased transparency and incentives for staying loyal to a brand are also highly appreciated.

For marketers looking to quell worries about increased prices or shrinkflation, communication is a great tool. Creating messaging around the unchanged aspects around certain products or services can help assure shoppers of a brands’ continued commitments to continuity in price, ingredients, or suppliers.

Consumers continue to notice product shortages

Many product-sellers in Canada have been experiencing supply chain disruptions over the past few years, which can lead to product shortages. Consumers have taken note: nearly a quarter of respondents (24%) have seen a decreased availability of at least one product or service.

Of those who’ve missed the opportunity to buy a product or service, most (75%) reported missing certain grocery store goods. Other product types that were noticed to be periodically unavailable were medicine (by 54%), domestic appliances (by 27%), and electronics (by 26%).

The healthcare system in Canada has experienced a few struggles in recent years; the drug shortage reflected above is only one such struggle. Many healthcare centres have also encountered staff shortages that led to reduced availability of healthcare services for some. Health-related services were found to be less available by 39% of the respondents who have noticed decreased availability of a product or service and is the top-voted service type to have suffered from this change.

How are consumers reacting to product shortages?

When faced with product shortages, respondents who’ve noticed changes in availability of their intended purchases react in different ways. The majority (60%) choose to temporarily purchase an alternative product or service from a different company, but keep looking for the one they originally sought out.

This is good news for companies experiencing shortages, as it means their customers aren’t lost forever. However, not all customers react the same; a quarter of respondents to this question (26%) buy another product/service from a different company and stop looking for the original for good.

Proactive measures to maintain customer loyalty

With economic challenges on the horizon for buyers and sellers alike, it’s more important than ever for SMEs to focus on customer retention and loyalty. According to Gartner research, retaining and selling to an existing customer is more cost-effective and profitable than acquiring a new one.

Many companies may find themselves in situations where making adjustments to products and services is the only way to respond to inflation in Canada, but that doesn’t mean they can forget about the customer’s experience. In these instances, proactive responses to rising prices and shrinking product sizes and availability can help lower the risk of losing customers to competitors. Amongst the measures that companies can employ to improve customer retention, efforts should be made to:

- Be transparent about changes to the price, scope, size, and availability of products and services

- Communicate regularly with customers to nurture and continue a relationship in difficult economic times

- Incentivize consumers to retain their shopping habits with discounts, rewards, and especially loyalty programs that will help your business understand consumer behavior and respond to it in a timely manner

Survey methodology:

To collect the data for this study, Caperra conducted a survey from March to April 2023. To do this, a sample of 1,010 people were selected. The sample of participants is representative of the population of Canada regarding aspects of age, gender, and provincial residence, and the criteria for selecting participants are as follows:

- Between 18 and 65 years old

- Must be at least partially in charge of paying for home expenses and goods