81% of Canadian employees say their pay has not kept pace with the rising costs of commuting to work.

What we will cover

- RTO mandates continue to face resistance—and inflation is making things worse

- Recommendation #1: Cover costs through employee stipends

- Recommendation #2: Reduce costs through flexible policies and on-site events

- Recommendation #3: Help employees budget better through financial wellness programs

- Recommendation #4: Offset costs to be at the office by reducing hybrid and remote worker compensation

- Leverage the right HR software to implement effective cost reduction solutions

As businesses ramp up their efforts to get employees back in the office, workers say the higher cost of things such as gas, food, and child care is dampening their return-to-office (RTO) enthusiasm.

That’s according to Capterra’s 2024 Cost of Work Survey, which collected 250 responses from Canadian employees.* Sixty-one per cent of respondents tell us their personal financial costs to work have increased in the last 12 months. And of those who have experienced higher costs, 81% say their wage or salary has not kept pace.

What was once a foregone conclusion —employees pay all the costs to be at work— can no longer be assumed. If you’re an HR leader or other executive charged with motivating your company’s workforce to return to the office, you may need to share at least some of these costs with your employees. The good news is that there are cost-effective solutions you can implement, in tandem with the right HR software, to mitigate these rising costs for your workforce.

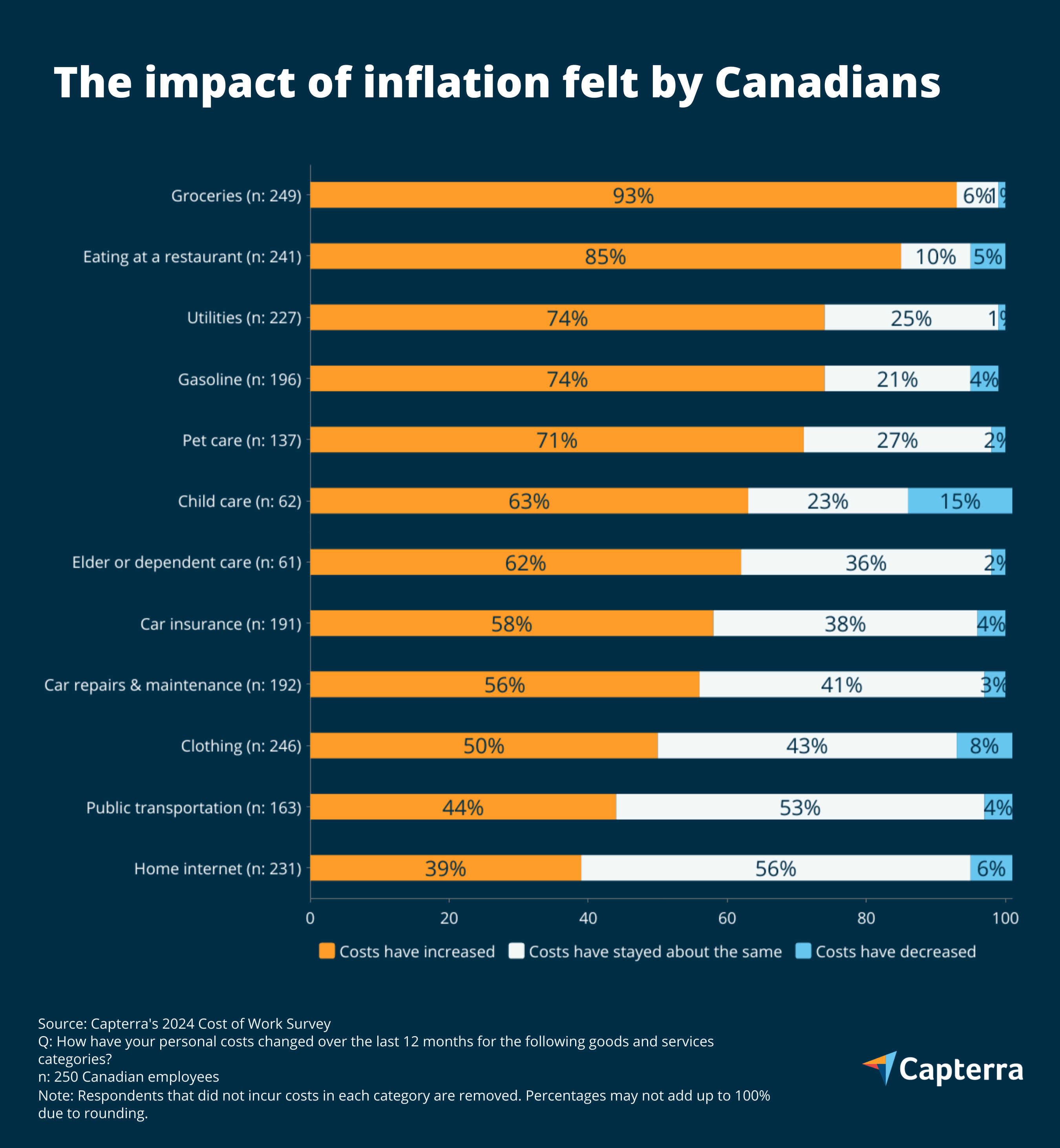

- Most employees say their costs for groceries (93%), gasoline (74%), and child care (63%) have increased in the past 12 months.

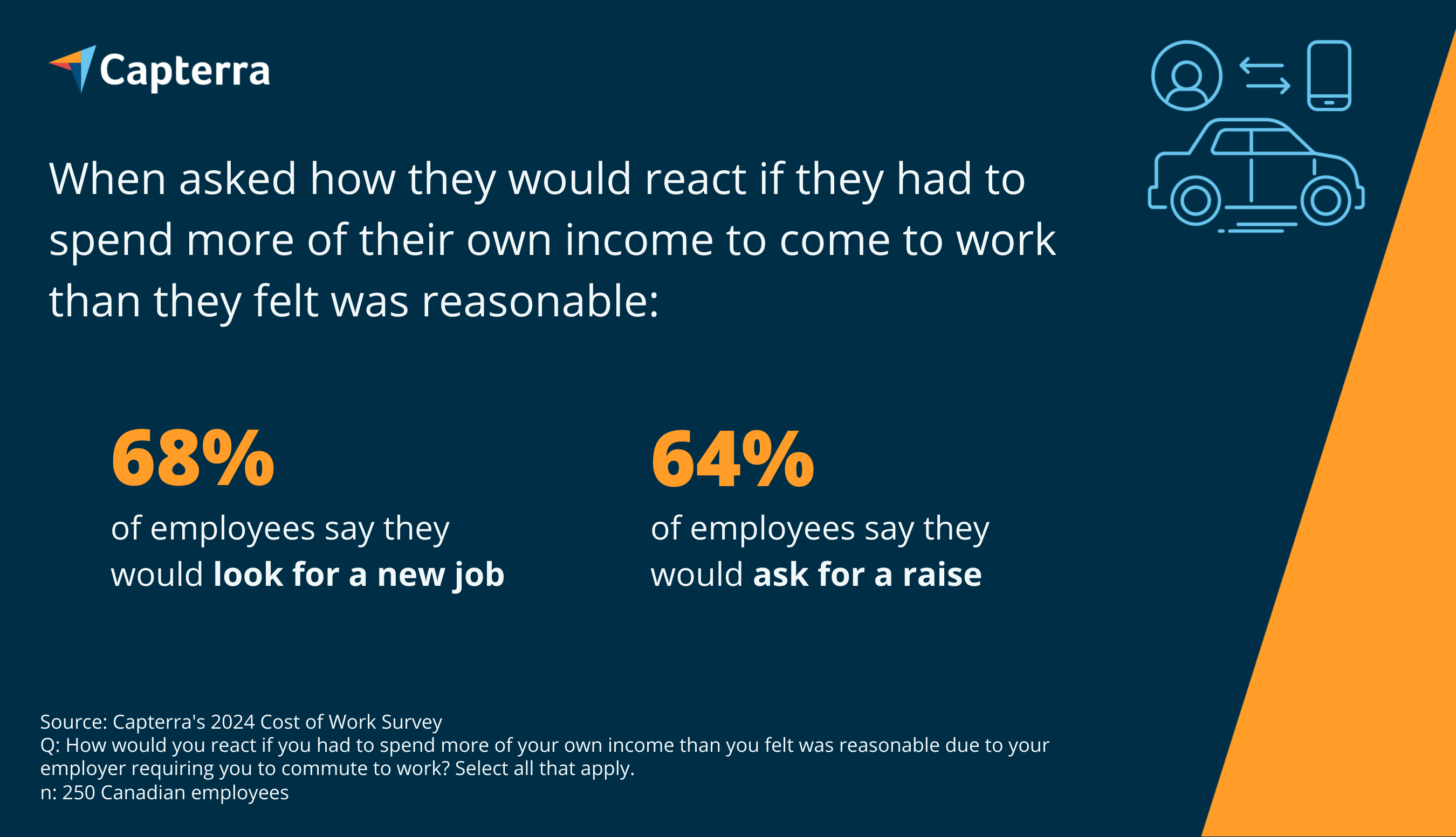

- If they had to spend more of their money than they felt was reasonable to go to work, 68% of employees would look for a new job and 64% would ask for a raise.

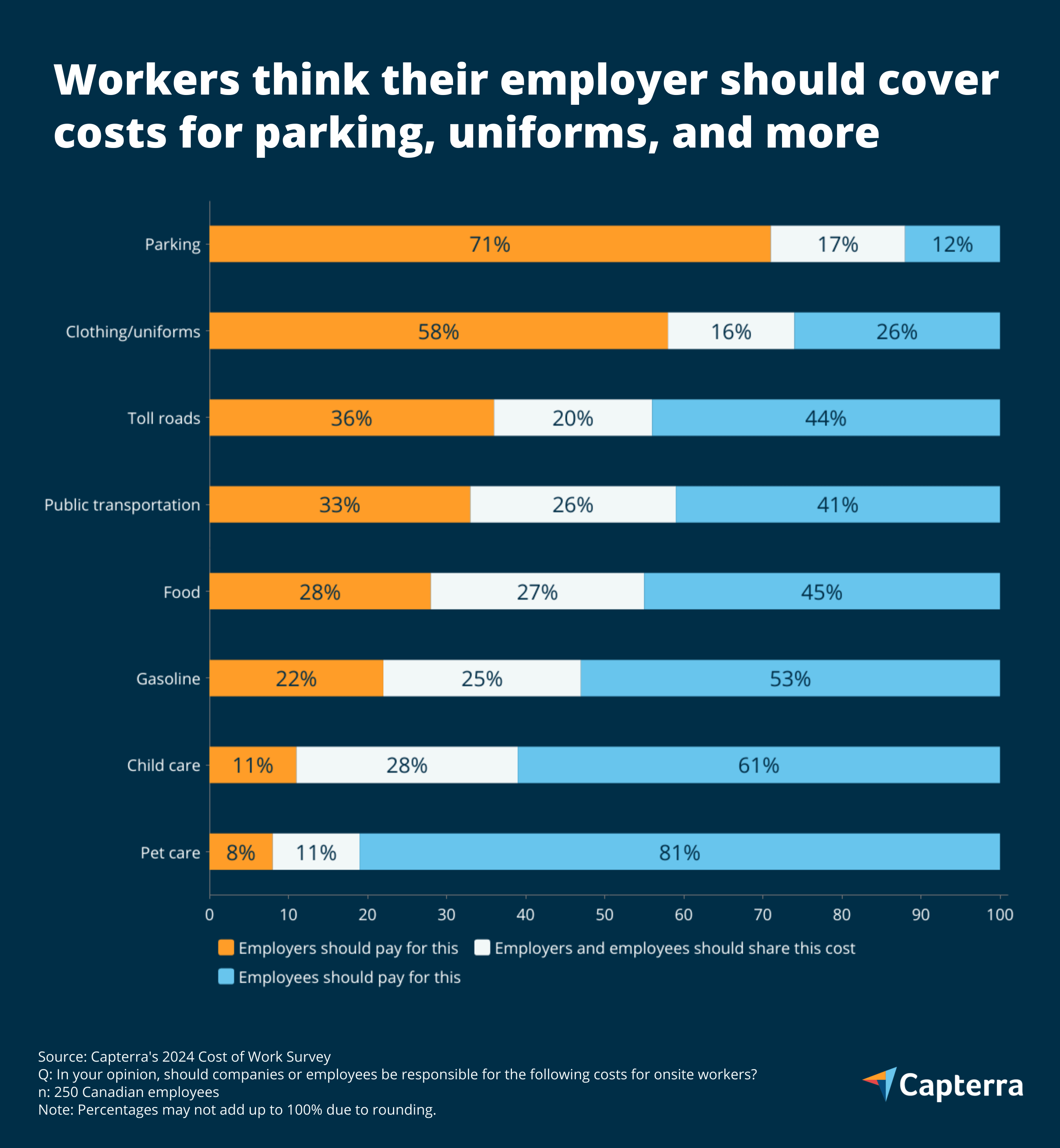

- When working on-site, a majority of employees feel their employer should completely pay for parking (71%) and uniforms (58%). Most also feel their employer should at least share the cost of public transportation, toll roads, and food.

RTO mandates continue to face resistance—and inflation is making things worse

While companies have been eager to get employees back in the office more to promote collaboration and enhance the company culture, employees themselves haven’t been as keen on the idea.

Our survey data reinforces this:

- Thirty-six per cent of Canadian workers now work at a company office, store, or other workplace full time, despite only 9% saying this is their preference. The opposite is true of remote work: 54% prefer it, but only 22% now do so full-time.

- Of the 21% of employees who are required to work more days on-site at a company workplace now than they did a year ago, a majority (80%) feel negatively about it.

Employers have tried organizing more office events and punishing employees who don’t comply to combat this reluctance with varying degrees of success. And now a new obstacle stands in their way: inflation.

A majority of employees from Canada in our survey say the cost of things such as groceries, gasoline, child care, and car repairs have all increased where they live in the past 12 months. This has, in turn, raised the price to come to the office.

All told, 61% of Canadian workers in our survey say the personal financial cost associated with their current job has increased in the last 12 months. Because they incur both on-site and remote costs to work, hybrid employees (70%) have been hit particularly hard compared to fully on-site (60%) or fully remote (43%) employees.

Post-COVID, employers have raised their wages rapidly to attract and retain talent. But rising costs, such as those for rent, have eaten into wage gains and made them less sufficient to cover higher expenses to be in the office. [1] Predictably, of the workers in our survey who have seen their costs to work rise, 81% say their wage or salary has not kept pace to compensate.

If your company wants workers in the office but doesn’t address this cost-of-work crisis, employees are prepared to act.

Fortunately, we have a number of recommended solutions that you can mix and match to help mitigate these costs for your employees, some of which cost little or nothing to implement.

Recommendation #1: Cover costs through employee stipends

Pros: Provides direct financial relief

Cons: Can add considerable cost for employers

The most straightforward way that companies can reduce the cost-of-work burden on their employees is by taking on these costs themselves. And employees aren’t holding back on which costs they think their employer should be covering.

A majority of Canadian employees in our survey say if they’re coming to the office, their employer should completely cover the cost of parking and any clothing or uniforms required by the company dress code. Most also say their employer should at least share the cost of public transportation, toll roads, and food.

Expenses such as meals and uniforms that apply to everyone can be provided outright without much employee involvement. For other costs that vary by employee, it’s best to use a stipend system.

Whether it’s a stipend for commuter costs or child care, essentially, your company agrees to cover a set amount for every employee every year. Employees merely need to log their expenses as they accrue them, and the amount can then be reimbursed in their next paycheck.

Recommendation #2: Reduce costs through flexible policies and on-site events

Pros: Improves the employer value proposition, makes working on-site more attractive

Cons: Events can be noisy or distracting for non-participants

If there is room in your company policies to adjust office requirements and lower costs for your employees, now is a good time to consider them.

One example is the dress code. With the cost of clothing going up, buying more expensive items, such as blazers or dress slacks, can put undue financial strain on employees. Having a more casual dress code for the office lowers costs and reduces some of the friction to come into work. In fact, 37% of Canadian employees say they would enjoy working on-site more if there was an informal dress code.

Another example is having a more flexible work schedule. If employees are expected to commute to the office during heavy traffic hours every day, this increases their cost for things such as gas, toll roads, and public transportation. If, however, they have some flexibility around when they can arrive and leave the office, they can avoid peak congestion and lower their costs. Progressive employers should consider adopting a four-day workweek to really lower these costs.

Finally, if employees are paying to have someone take care of their children or their pets while they’re at work, you can offset this cost by having events where employees can bring their children or pets to work with them. Twenty-seven per cent of working parents say they would enjoy working on-site more on a “Take Your Child to Work Day,” while 40% of pet owners say the same thing about a “Take Your Pet to Work Day.”

The only caveat here is that your office is still a shared space, and non-participants may not appreciate the added distraction. For example, 26% of employees who aren’t parents say they would enjoy working on-site less on a “Take Your Child to Work Day.” Depending on your office space, you may need to silo off a separate area for these special days to keep everyone happy.

Recommendation #3: Help employees budget better through financial wellness programs

Pros: Adds little cost to the employer, can reduce financial stress and improve morale

Cons: Doesn’t reduce any work expenses

If you lack the funds to cover work costs for your employees, another option is to offer financial wellness benefits that can help them better manage the costs they have.

Provided by a qualified coach in-person or, increasingly, through dedicated software, financial wellness programs give employees access to personalized financial support. They can track their expenses, set up savings plans, and come up with a strategy to meet their financial goals.

Gartner says “In providing financial coaching as an employee benefit, organizations can help offset their employees’ stress by minimizing the amount of time they spend worrying about money at work.” [2] This offset stress translates to higher office happiness: in our survey, 44% of employees say they would enjoy working on-site more if they had access to financial wellness benefits.

Recommendation #4: Offset costs to be at the office by reducing hybrid and remote worker compensation

Pros: Incentivizes employees to be in the office more, has the potential to save the company money overall

Cons: Makes remote work less attractive, could cause tensions between on-site and remote workers

Whether companies like it or not, our data shows that employees would prefer to be remote more often than being in the office. Savvy employers will use this to their advantage.

When employees were forced to work from home (WFH) at the onset of COVID-19, companies began offering WFH stipends so employees could cover costs for needs such as Wi-Fi and putting together a suitable home office. Four years later, this benefit is still around in many companies.

But, with 66% of employees who work from home at least part of the time telling us their home office fully meets all their needs and preferences, this WFH stipend is not as necessary as it once was. Simply getting to work from home at all is a benefit in and of itself in 2024, so you can consider removing this WFH stipend from your benefits package (or save it for new hires only at the time of their hiring) and direct those savings toward mitigating costs to be in the office.

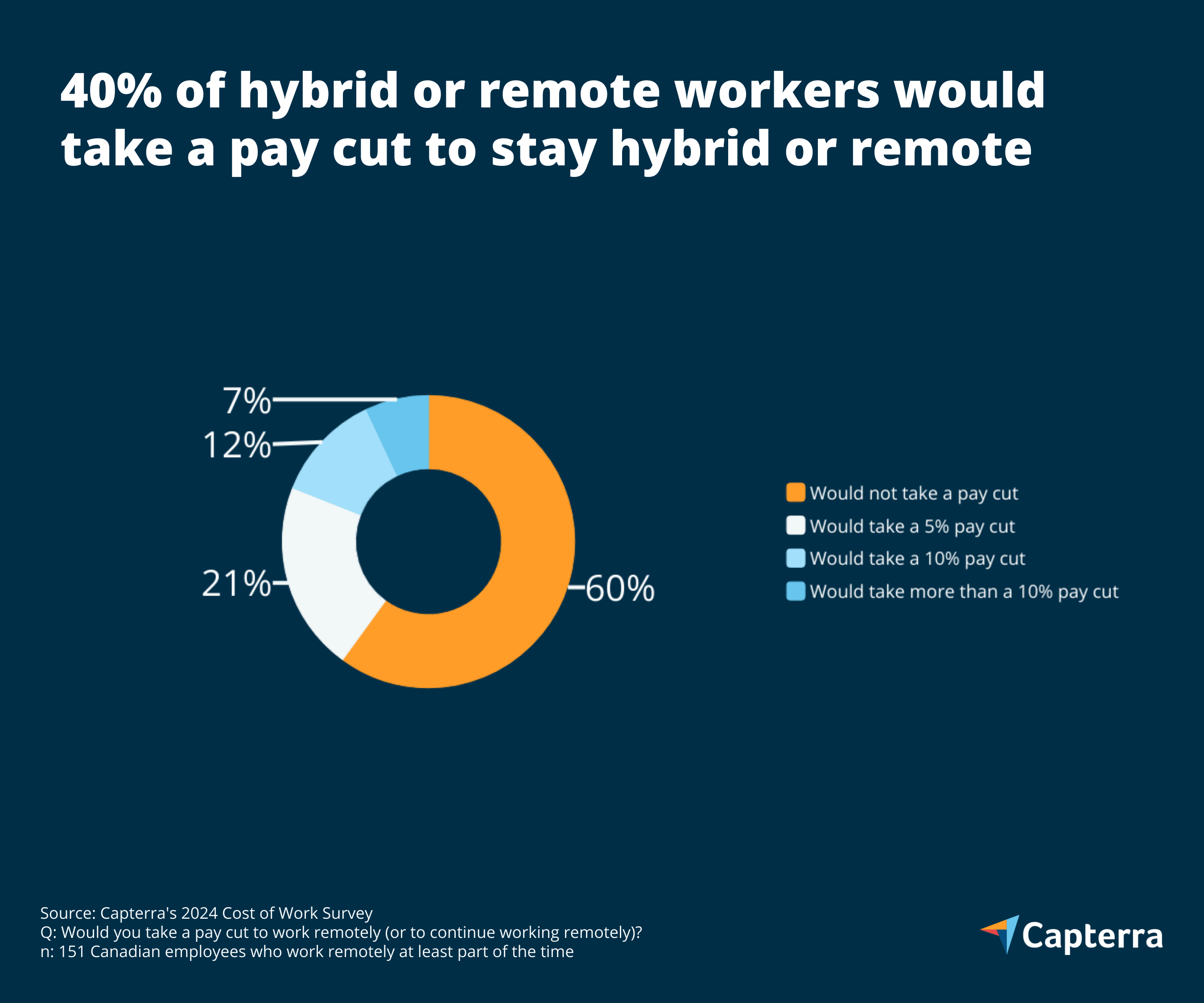

You can take this “cost offsetting” even further with your compensation structure. In our survey, 40% of employees who work remotely at least part of the time say they would take a pay cut to keep working remotely. By tying pay to where employees work —increasing it for those who work on-site more and decreasing it for those who work on-site less— you can incentivize workers to commute to work and give them more money to cover relevant costs.

For context on how much you may need to increase on-site worker pay, a 2022 survey of over 300 Canadian adults found that they would return to the workplace full-time in exchange for a 27% increase in salary. [3]

Leverage the right HR software to implement effective cost reduction solutions

Prior to 2020, employees absorbed the costs to work without questioning it. In 2024, however, higher prices have made workers more aware of what they spend to be at their jobs. If companies want their employees to commute to work happily, they must tackle this cost-of-work crisis head-on.

Implementing the solutions we’ve covered here will help, and this process is made even easier with the right kind of HR software:

- If you’re administering a commuter or child care stipend, a combination of a stipend administration system (where employees can track allotments and submit expenses) and payroll software (to add covered expenses to paychecks) can automate this process and make it easy to manage and update as needed.

- Through the right employee scheduling software, HR departments can still track important data such as attendance, hours, and office usage even if employees are on a flexible schedule.

- Financial wellness software can connect employees with personalized financial coaches and provide tools to help them better budget their paychecks.

- Compensation management software can help you dial in wage and salary numbers to incentivize on-site work without too much remote employee attrition.

If you’re operating on a tight software budget, a lot of these tools offer free trials. Moreover, there are also free software systems in a lot of these categories that can be leveraged as well.

If you liked this report, check out our other research on the latest HR and talent management trends:

Methodology

*Capterra's 2024 Cost of Work Survey was conducted online in March 2024 among 2,716 respondents in the U.S. (n: 250), Canada (n: 250), Brazil (n: 244), Mexico (n: 245), the U.K. (n: 248), France (n: 244), Italy (n: 250), Germany (n: 246), Spain (n: 246), Australia (n: 248), and Japan (n: 245). The goal of the study was to learn about the costs employees incur to work whether remote or on-site. Respondents were screened for full- or part-time employment.

Sources

- Average asking rental prices reached $2,193 last month, CTV News

- The Cost-of-Work Crisis Reaches a Breaking Point: Act Now to Prepare for the Future of Work, Gartner (full research available to Gartner clients)

- Workers looking for big pay bump if forced back to the office full time, Canadian HR Reporter